Carnegie Wealth Management believe you and your family should be able to benefit from advice in this area, to then be able to make an informed decision about your estate and how you can potentially preserve your family’s future.

Trusts are an important consideration in the overall area of Estate Planning and Carnegie Wealth Management are experts in Trust planning.

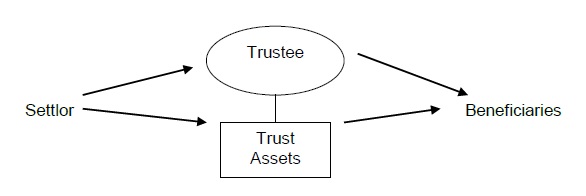

Trusts work in conjunction with your will but the important distinction is whilst your will directs your estate to the beneficiaries of your choosing, a trust can potentially protect your assets and gives your beneficiaries more control of when they want to take their inheritance.

Not everyone wants their inheritance immediately and by having a trust in place, it allows them to keep any assets within the trust until they want them.

The potential benefits are as follows:

Depending on your family circumstances, trusts can provide peace of mind that your estate and in particular, your family home, can only go to your chosen beneficiaries and will remain ‘in the bloodline’.

Carnegie Wealth Management have been advising on trusts for many years and have helped many families achieve their objectives of protecting their assets that have been built up over the years.